Supernovice

Members-

Posts

573 -

Joined

-

Last visited

Content Type

Profiles

Blogs

Forums

American Weather

Media Demo

Store

Gallery

Everything posted by Supernovice

-

For those asking…Yes, a local official in Jackson, Mississippi misstating numbers, and then correcting the record 8 hours later is evidence of a vast conspiracy propagated by the highest authorities within the U.S. government.

-

I have an in-ground, and admittedly know nothing about them. do I need to pump it out if it is above the filter? i mean it is high but never really cared...or thought about it before

-

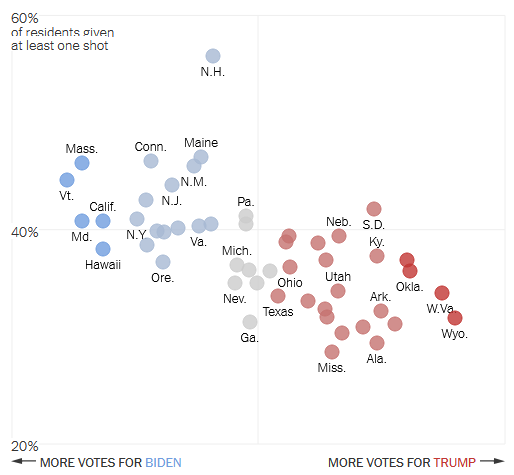

I'm not saying anything about who is or isn't vaccinated. It's just mind blowing to me that it falls along party affiliations- just an observation. I don't wish anyone to get sick and die. Again just commenting on how deeply held those beliefs seem to be- that they won't change unless they become personally impacted. Like everything else these days it's all very tribal. It's just interesting- that is all.

-

The ideological lines seem to have already been drawn. The below chart always blows my mind, and I've seen it even more granular on a county and congressional district level. The story doesn't change. Chickens will come home to roost. I'm not sure the unvaxxed will rethink it until they actually get sick.

-

Strong agree- the government just issued a statement which basically read: not so fast you greasy scumbags. Either way, crap like this doesn’t do much to inspire the vaccine hesitant. Damage= done.

-

Kind of disagree semantically here. IMO, it’s much more about overwhelming the health system rather than deaths. I.e. can you get a hospital bed if you need one? Not necessarily if x number of people die. Once (IF) the system itself starts collapsing we will quickly reintroduce restrictions. The career risk for the political class becomes untenable at that point regardless of party affiliation. Test case might be Missouri in a week or two- the healthcare system is getting close to a tipping point there as I type.

-

Goldman released a note last night on the global economic impacts. They aren't great. Rolling restrictions, continued supply chain disruptions etc...not a surprise to anyone paying attention. But that's what's generating today's headlines. Letting this thing run rampant within a partially vaccinated population is just the sort of thing I would do if I wanted it to gain resistance to the vaccines currently deployed. It is literally a matter of time imo.

-

Ya same. 2 yr old had it for like 24 hrs but it's hitting the 4 yr old harder. I am obviously paranoid it's not just a cold but don't want to traumatize the kid either with a nasal swab. Not sure how knowing it was COVID would change anything anyways. Everyone I talk to says there is a nasty cold going around. We normalize.

-

Am I late to the game on the NWS doing away with point and click forecasts? Now I get a forecast for "Central Middlesex County". Have I just not been paying attention, or is this new?

-

Trying to get caught up….so those that complained about mask mandates due to “infringement” on their personal freedom, are now complaining about business owners exercising their own personal freedoms and requiring masks to enter their stores? Ok ya- now I’m up to speed.

-

Today is the anniversary of Operation Red Wings which led to Michael Murphy and his team’s death- documented in Lone Survivor. I would highly recommend that book to anyone looking for some summer reading. Sad day for that community.

-

Noticed the lumber futures market moved into carry- I.e. pays you to store it. Doesn’t quite cover all carrying costs, but it’s moving in that direction. Should help some builders in here.

-

Looks like I struck a nerve- oops. You'll have to forgive me- was up all night worried about an employee. You see- they are having surgery today and I don't know how we as a company are going to pay for it. I wish there was something we could do, like some program or company that you paid a yearly fee into, and then they would cover an employee if they had some medical issues over a certain dollar threshold- like a deductible almost... it's a shame really.

-

Lol- In the big leagues we have these things called “corporate insurance programs” that allow for us “deciders” to not have to worry about such things…and focus on things like you know actually “running the business”. But please tell me more about you losing sleep over slip and fall accidents because surely you must be more worried about those- more plausible than a mask lawsuit.

-

Literally a joke. But ok dude. Whoosh.

-

How about the “Trump Virus” since it was our taxpayer money that funded the Wuhan Institute? See what I did there? Honestly at this pt who cares? We’re still in crisis mgmt mode (globally). Let’s get everyone in the world a vax that wants one then we can talk about responsibility if it even matters at that point. no doubt- agree a million % we’re going to be dealing w/ this for a while probs forever. Thank God it’s not like...legit the real deal and we can learn lessons to apply next time. Or not.

-

Not making any claims about being more dangerous- I.e. the variant itself. But certainly more infectious...like no doubt. Facts are case fatality rate in the u.s. is basically unch. since last year. Just saying...#facts. To each there own. Around here specifically very bullish on being - over Covid. Love it- no masks, kids playing...f-ing love it. But facts ( nationally) remain. Don’t even get me started on looking at this on a scale that matters I.e. globally.

-

I’m not playin ball with anyone on reddit...I suppose you said “reddit” to put some kind of negative connotation on it...but...It’s literally called facts. The India variant has out competed the b.17 in the uk and is undoubtedly doing the same here. Will our vax rates blunt it? Yes, and especially in New England specifically. But the fact is- nationally- not locally- it’s as dangerous for the unvaccinated as it was during the height of this thing...and will only get more dangerous for those people as time continues. So ya- get your vaccine.

-

Ok fair- then where's my 5-10% pullback? You called for a pullback in February/March- Major Indexes weathered the rising rate 'storm' just fine. I'm not picking a fight w/ you...it was more jbenedet's post that set me off. Which you nailed a response to so...? No beef here. The reason I brought your guy up...he tweeted recently and it made the rounds in my circle. He was talking about VIX term structure- and viewed it as a conspiracy that it fell on Fridays and rose on Mondays. Which- is actually a feature not a bug and implicit in the math behind it. But that wouldn't generate clicks from the people that follow that him. Either way I got quite the laugh, and he laid bare his charlatan ways for all to see.

-

Ah yes- the most important bearish event since the pandemic and major indexes are down *checks notes* less than 1%. I know you guys have a disaster fetish but this is beyond parody. To finish my Bingo card all I need is a quote tweet from ‘northmantrader’ or whoever. C’mon guys.

-

I really just got tired of our self appointed philosopher in chief ruminating on how the world is doomed because people (not him) are too dumb to interpret the news for themselves, blaming smart phones for the coming apocalypse etc etc ad nauseam. While he clearly only read the headline, not sure he even skimmed the article but if so clearly didn’t understand it, and failed to contextualize the source (Barron’s). But none of that stopped him from posting 5000 words on the subject. That’s why I stepped on his throat there- not to defend pharma as a whole.

-

What do you not understand about the words "INVESTOR CALL"?? No one is saying they are unbiased- holy crap. Get your news from a source other than Barron's I don't know what to tell you.

-

I was on the call...it was very vanilla nothing we don't already know. I don't get why everyone's up in arms about it? An investor call...with a summary published in Barron's? Yes- this was about the future of the company. Yes that means generating profits. Overall- positive for humanity- 2-3 months production time for a variant. So if (when) a new variant pops up with immuno-escape capabilities (incorrect phrasing) we can all still go about our lives and nothing changes. Net positive.

-

They bull trapped AMC at 10:05 est and it looks like sh*t now. set your stop losses.

-

Linked for your viewing pleasure.