-

Posts

91,808 -

Joined

-

Last visited

Content Type

Profiles

Blogs

Forums

American Weather

Media Demo

Store

Gallery

Everything posted by ORH_wxman

-

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Yeah unlikely we get skunked completely....esp once you are getting up into northern SNE. Long ways to go though before anything...even the 12/18-19 threat is 5 days out and most of us in SNE are not in the game with that threat....so we're still probably a week-plus out from our next snow threat. A lot can change. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

The 12z GFS is actually a great example to have right after the 06z GFS.....while the 06z GFS shows how things can go right, the 12z GFS shows how things go wrong. We're reliant on timing since we don't have true downstream blocking. That -NAO is still east-based so it's not going to provide much resistance for cutters....not until it retrogrades more into the central part of the domain which it might after Xmas....but prior to that, we are still at the mercy of timing. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

If it's beyond 3 days or so, that's probably the right approach. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

That was a great SWFE. Came in like a wall (so did 12/16/07 too 3 days later). I remmeber I was actually out running a couple errands and got back home just in time...it was prob around 11-1130am or so. Like a few weenie flakes were falling right as I pulled back in the driveway and then about 5 minutes later I looked back outside and it was S/S+....just ripping. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

There may be 2-3 chances between 12/18-12/25....hopefully we can cash in. The pattern is really active and there's a lot of cold bleeding in after the 18-19th. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Looks good north of the pike....but my gut is that one ends up being NNE....we'll see though. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

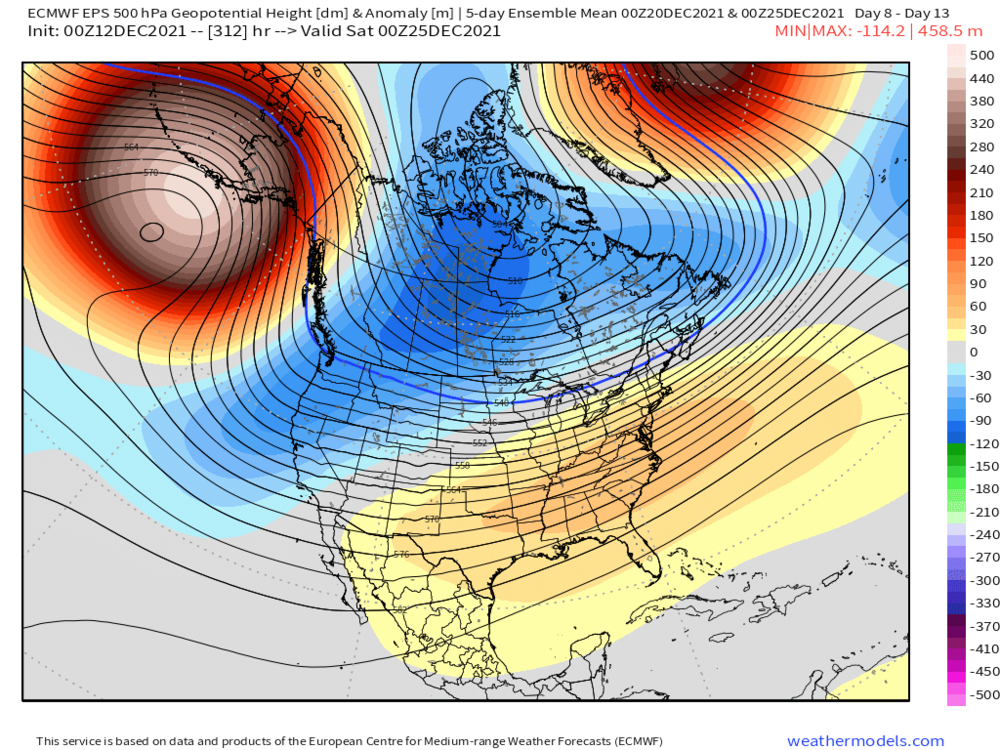

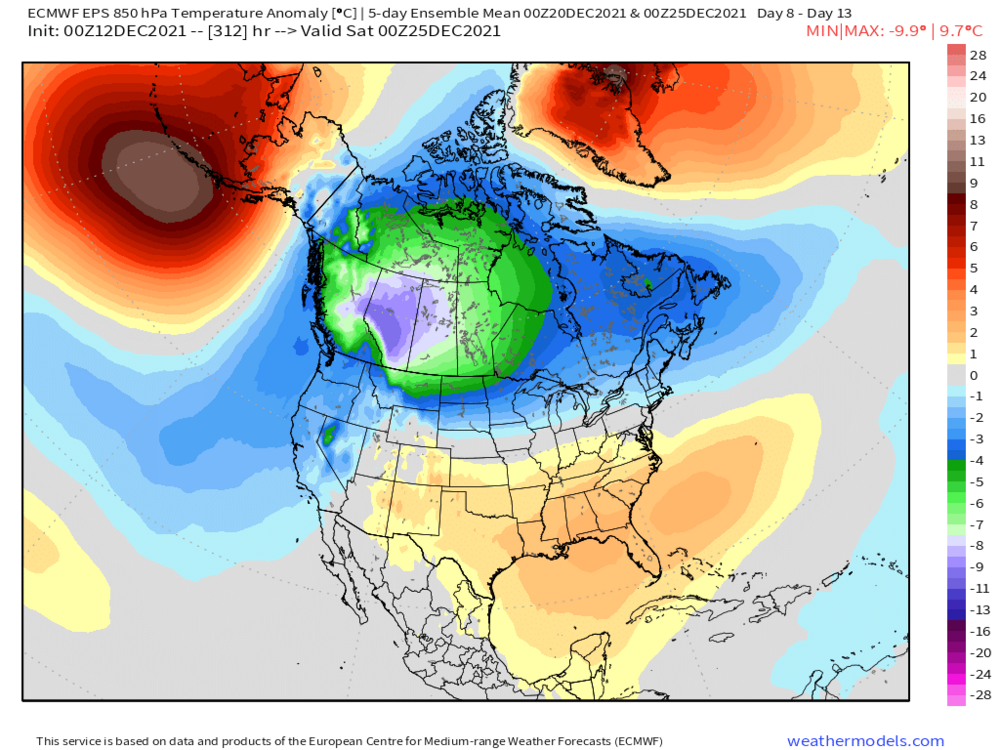

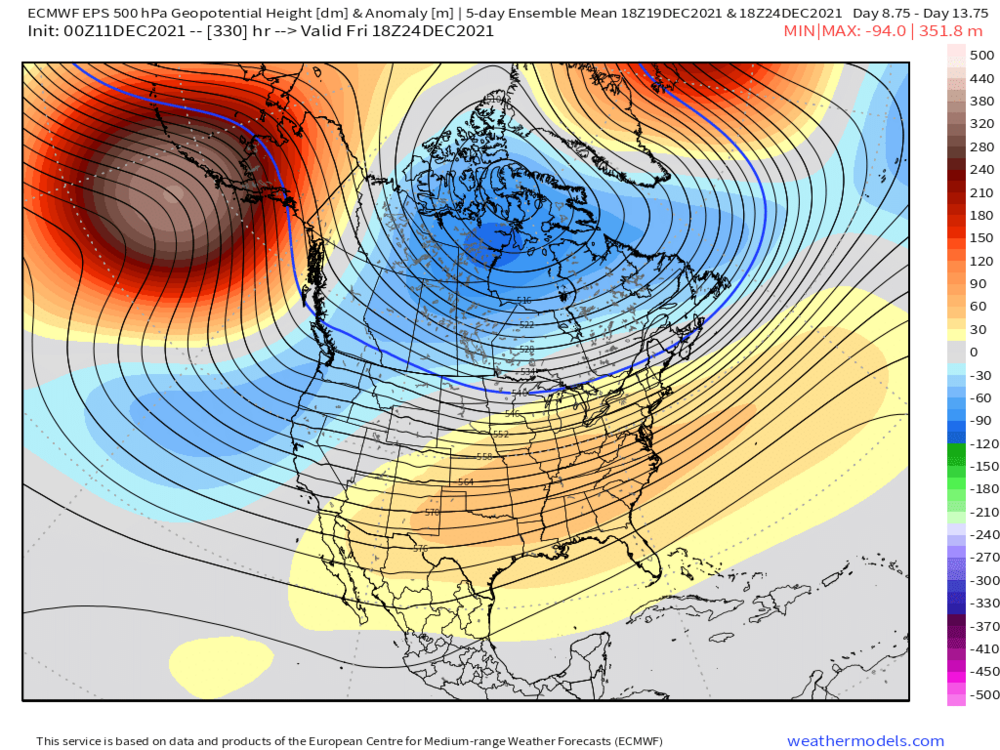

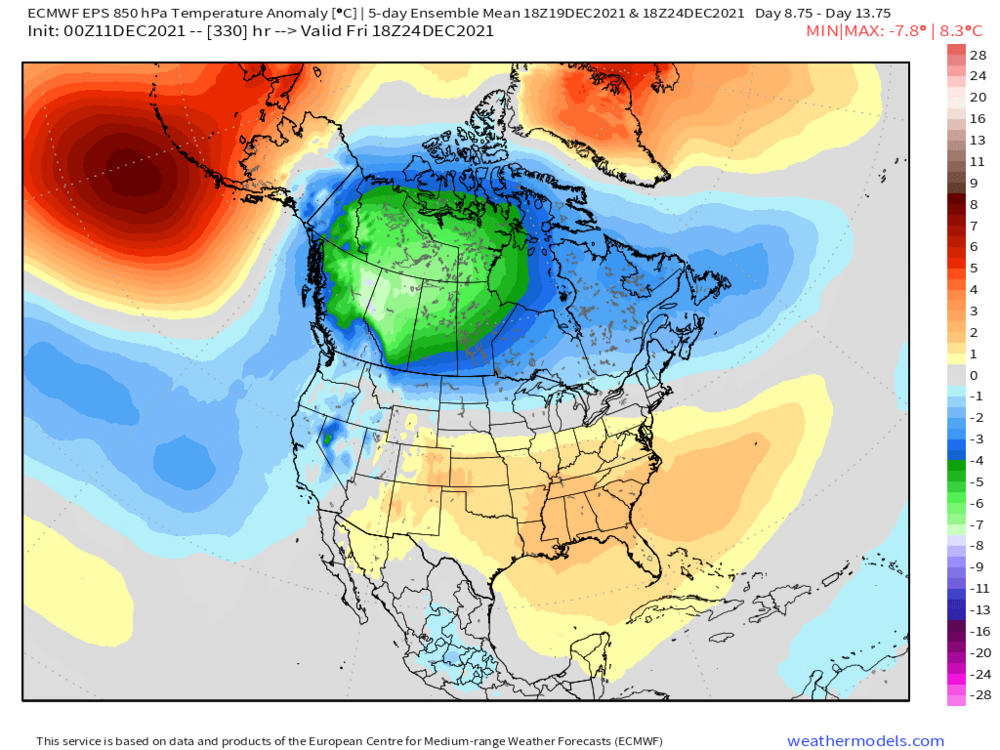

Here’s the 5 day 500mb anomaly mean ending 00z 12/25 and then the 850mb temp anomaly below that for the same time....we’ll have chances with that look but with the SE ridge, cutters are still a risk. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

-

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

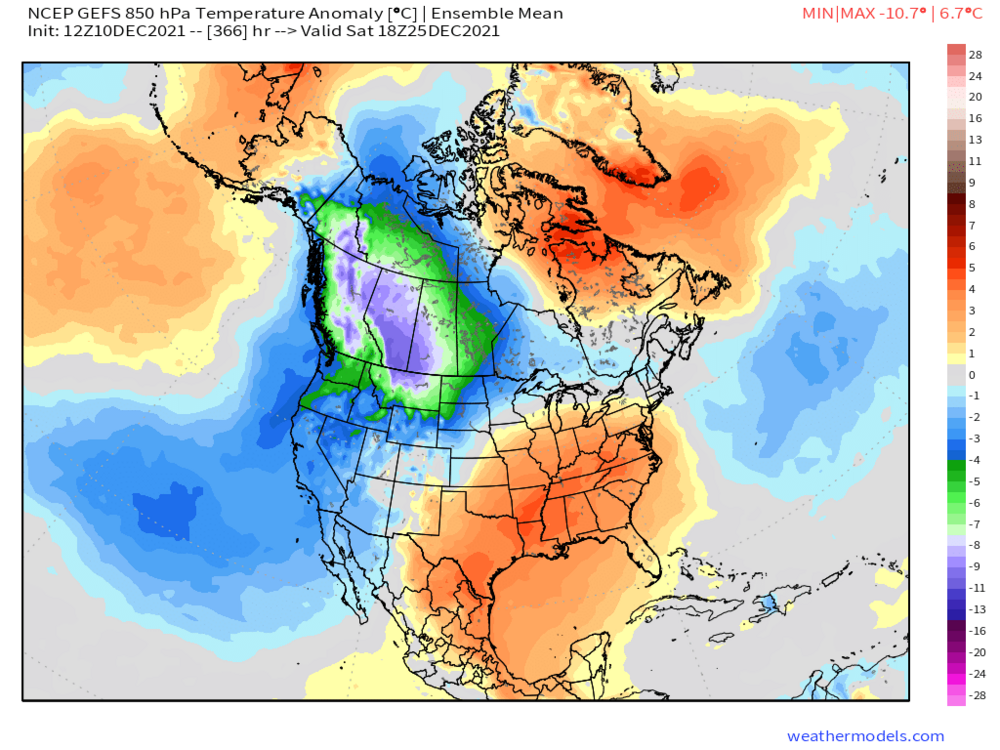

Definitely plausible. There’s pretty decent ensemble support for some potential wintry systems between 12/20-12/24 -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Euro/GFS/GGEM all have something to watch for 12/20 timeframe. They also have one for 12/18 but it seems like NNE might be the place to be for snow in that one. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

There’s always plenty of room for a grinch storm in there. Esp with that SE ridge still around. But at least there’s good cold bleeding down and it’s an active jet so we should have chances going forward after next week’s torch. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

-

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Ensembles on both GEFS and EPS show some potential there in that Dec 19-24 range. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

12/22-23/69 had a nasty ice storm over central MA. Prob the one. Dec 1973 is a good mention by the others but that was a full week earlier on the 16th. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Yeah gotta go back to 2015 really....though you could maybe make a case for 2018 (first 10 days were brutal cold with the 1/4/18 bomb....however the rest of the month was a torch). Jan 2019 was cold, but not all that snowy. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

It's clown range but it's a very good look....esp for interior. That high is kind of moving east to coastline might have issues by the time the storm comes up the coast, but overall it's at least something that is plausible once we're done with next week's torch. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

-

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

It was a troll post meant to elicit a response. -

I always love reading about the old ski resorts back in the day that relied 100% on natural snow. So many of them were open for like 4-6 weeks all winter. Or even worse in some awful years. A lot of the old mom and pop hills might open for 3-4 weeks in January/February and that would be it. They typically made most of their money during February vacation week so that is the week they hoped to be open.

-

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

12z runs so far today definitely have some chances starting around 12/18-19. They would be SWFE type events but it’s obviously a change from the “no chance” regime of the next week. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Eh, I think the December composite is probably toast unless we get a huge swing in the final 10 days....too much western troughing and a lot of eastern ridging. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Yeah if we're gonna have a really mild day, lets see 70F....55-60 is boring....Thursday could make a run if we warm sector early enough in the day. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Yes especially early month....but the 2nd half of the month is pretty decent for snow climo...esp interior. So punting December would be pretty bad....esp in a Nina. I honestly can't remember the last good La Nina where we punted December. Might have to go all the way back to 1971-72. Hopefully this one turns it around in the final 10 days which is very possible. It's an active flow, so the snow events can come in a bunches once some of the timing breaks your way (ala Dec 2007 or 2008) -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

I get the frustration....it's pretty bad to have nothing on the horizon on 12/10.....and we might end up punting all of December until the pattern gets less hostile. I am not quite ready to punt the final 10 days of the month yet though....that's a very strong EPO ridge forecast and if the western troughing is just a little less than shown, we'd have chances I think. But it's definitely a headwind right now. That western trough is very deep. -

December 2021 Obs/Disco...Dreaming of a White-Weenie Xmas

ORH_wxman replied to 40/70 Benchmark's topic in New England

Yeah it was right after that cold tuck event. We had like 3-5” of snow followed by the sleet/ice combo and the ice stayed on the trees for days.