-

Posts

5,543 -

Joined

-

Last visited

Content Type

Profiles

Blogs

Forums

American Weather

Media Demo

Store

Gallery

Posts posted by csnavywx

-

-

Btw, I think the unusual convective behavior last night was in part due to the extreme (and highly stratified) Bay water temps imparting a lot of latent and sensible heat flux to the atmosphere when that back door cold front and aggregate outflow came in to help trigger it after sunset (along with some radiative cooling at the anvil level post sunset). Bay temps at 1.5m were running at 86-90F and probably quite a bit hotter in the top 1-2 ft.

Storms did their job last night and temps are back down to 82-83F today.

-

8

8

-

-

On 6/24/2025 at 12:46 PM, GramaxRefugee said:

Was just gonna mention about PAX. They've traditionally been pretty good. Starting to wonder what's up this year.

As to Balto...it's been off for many years, starting when the MD Science Center installed some solar PV panels next to the instrument. Added several degrees to every reading. After a while LWX removed them from their list for a few years. I (for one) will never reference that site again, winter or summer.

Maybe someone knows something about PAX. (There's significant knowledge hidden around AmWX; just need some patience usually)

The sensor is "in-spec". But it does tend to run 1-2 degrees warmer than it should and about a degree too soft on dewpoints. (This is with me various handhelds against the main ASOS sensor). But it's closer than I initially thought when I started to suspect it was too warm. It was at least 102-103 here on Wednesday.

A few factors that helped:

Evapotranspiration effects here tend to peter out faster than nearby stations because of lower tree cover and a lot of grass that tends to cure and brown quickly under very hot and dry conditions. That happened in just 3 days here this week. Note that during the peak temp, dewpoints dropped rapidly, indicating drier air from aloft mixing down as sensible heat flux increased relative to latent heat.

There was no gradient flow and nearly perfectly barotropic conditions with a lot of subsidence and very strong vertical mixing. This prevented a sea breeze from properly forming on time and heavily stratified the surrounding waters. I was in that water in Pt. Lookout on Monday and the top layer was easily 10F+ warmer than 1-2m down. Lack of any appreciable mixing meant that the skin temp of the water surface was very hot and that helped disrupt/delay a sea breeze circulation in this locale.

-

7

7

-

4

4

-

-

Did ya'll enjoy your trip to Dubai yesterday?

The pics of that dust wall gave me Persian Gulf flashbacks.

-

1

1

-

-

Got smoked here at Pax. Lotta 55+kt wind gusts (64kt/74mph peak) and 1/2" hail. Lasted about 10-15 minutes.

-

5

5

-

-

Nice supercell split to the NW of DC. There's an old outflow boundary (and a bay breeze!) to the east that could spell some trouble if those begin to interact with it.

-

3

3

-

1

1

-

-

On 5/6/2025 at 11:56 AM, Typhoon Tip said:

The sun needs another half billion years of life and that'll do it. Lol Old Sol is a mid aged star... over the next billion years it will increase in luminosity by almost 10%. Then it will begin fusing helium, and start expanding... It'll burn helium for another couple of billion years but then it will begin to expand so vast that it will first engulf the orbit of Mercury, Venus some hundreds of million years later, to probably knock on Earth's doorstep. It will be a cooler red giant by that time, but ... "cooler" is a relative term. Earth will be a cinder. Glowing in a lifeless infrared thermal radiance. And, as the expulsion by the giant phase start sas it will impose a lot or orbital drag; Earth's could decay and end up inside the envelope of the sun's our layers. The end.

We really are approaching the late innings of this planets nurturing life potential. Demarcated as the "Goldie Locks Zone" ... it's the orbital distance that is ideal for liquid water, and a planet's only magnetic field protecting it from harsh radiation from space ...et al, allowing all that is under the sun and our history, including Trump, to have ever existed ... LOL. But, the hell on Earth he brings - or is trying to - will get here without him, given enough time. When that GLZ migrates out and leaves Earth behind, we'll convert the oceans to WV and that'll put us in a Venus predicament. Some models have Earth like Venus in a couple billion years.

But, folks need to be aware that within a single life time or two, none of that matters. The "ecological domino collapse" scenario is not just plausible, due to rate of climate change surpassing biological adaptation rates.

In fact, that can happen while the Earth is still technically capable of supporting complex life, including humans. The codependents is more than a first order derivatives. There are transitive/non-linear stresses that take down 2ndary and tertiary ... n degrees of separation life. These are the dominoes. Such that they were indirectly still needing the total vitality of interrelated health of each input into the system- entirely intuitive. This can all happen quite swiftly... leaving a period when the Earth could still have breathable air, albeit warmer, with oceans still lapping at shores ... barren otherwise. Life in the ocean is not unaffected by all this. Deep ocean perhaps would survive the CC attribution death waves...

This can all happen quite swiftly... leaving a period when the Earth could still have breathable air, albeit warmer, with oceans still lapping at shores ... barren otherwise. Life in the ocean is not unaffected by all this. Deep ocean perhaps would survive the CC attribution death waves...

On geologic timeframes, I agree we're in the last act. It's no longer even possible to get a snowball scenario now, insolation is already too high. The drawdown in GHGs over the last ~300-500Mya has mostly neatly offset the increase in insolation over time but that parameter space is now limited on the downside. I would venture a guess that current continental drift resulting in another supercontinent+2-3% insolation puts temps well above Eocene levels and ends the golden age of habitability.

In either the short or long run, if you pancake the ETP temp gradient with either GHGs or insolation, you kill off most marine life during the transition. If it happens quickly enough, then you can end up with Canfield oceans -- which I would describe as a weird form of undeath (purple water and green atmosphere from euxinic conditions). In the very short run, we're extremely close (450ppm) to tipping over in the Southern Ocean with regards to ocean acidification causing widespread aragonite undersaturation, what I would consider the first step in that process.

-

2

2

-

-

4 hours ago, LibertyBell said:

how do you feel about these ideas to drop insolation 1-2 percent by introducing SO2 particles into the upper atmosphere?

it would have to be done on a yearly basis, beginning around 2030

Dangerous risk of termination shock and unexpected circulation changes. But I do think it will be done anyways.

-

1

1

-

-

Planck feedback/response stops any sort of Venusian runaway on this planet. Would take much higher insolation to get us there.

Much more worried about plant and/or soil carbon stock turning unstable at current temperatures. It's been showing signs the last few years, esp with large emissions from respiration. South America and southern Africa in particular do not seem to be taking it well. Some of this is probably due to monsoon trough migration via differential hemispheric heating and boosted non-CO2 warming recently from aerosols and higher-than-trend CH4, causing a lopsided NH response. But if the Amazon and southern African tropical sinks can no longer provide a brake, then that will cause an immediate and relatively strong increase in the airborne fraction.

-

2

2

-

-

Isn't there a pretty well documented increase in C/EPac trade winds over the last 40+y? I'd think that (plus the aerosol pattern effect) would have a pretty drastic effect on SST patterns and the downstream Pac climate indices.

Also probably can't get away from the insane post-2020 NPac/NAtl warming (N Hem in general) and the effect it's already having on the position of the ITCZ/monsoon trough via response to differential warming.

-

Actually really like this setup for some semi-discrete or discrete cellular activity (as shown by the NAM). While the best forcing goes north with the surface low and south with some trailing mid-level forcing and better cape, there is still some forcing for vertical motion here and some weak capping with halfway decent CAPE. Could be just enough to suppress crapvection and allow for more discrete activity to thrive, esp towards/just after sunset.

-

3

3

-

-

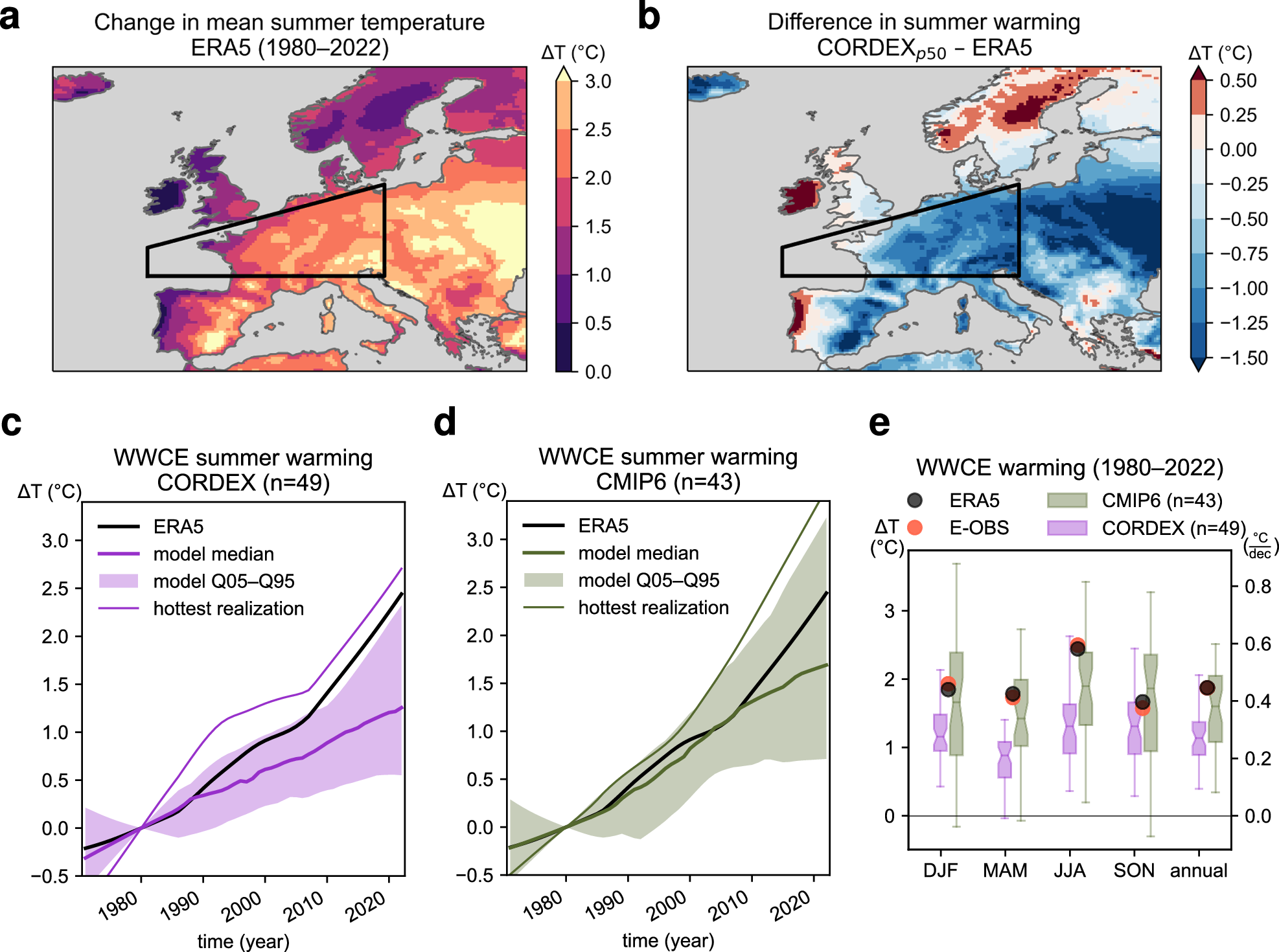

On 3/21/2025 at 1:51 PM, TheClimateChanger said:

A little glimpse into our collective future:

TRACC/CMIP-6 is already behind the curve:

On full blast from here with Med shipping sulfur emission controls taking effect this year.

-

1

1

-

-

On 2/24/2025 at 8:49 AM, bluewave said:

Since the governments of the world can’t get their acts together, it’s going to come down to the insurance and mortgage companies to enforce climate policies on the general public. Instead of taking a coordinated global approach, this will be done in an uncoordinated piecemeal way. So the governments are essentially punting the ball to the private sector and telling them just to do whatever you have to in order to stay solvent in the face of increasing extreme weather events.

https://www.yahoo.com/lifestyle/fed-chair-warns-high-risk-185451042.htmlFederal Reserve Chairman Jerome Powell has warned that mortgages will be difficult—if not impossible—to secure in some high-risk areas in the future.

As storms and wildfires pummel certain areas of the country, causing insurance rates to skyrocket, particularly in Florida and California, the chairman foresees a day when many areas will have turned into mortgage deserts.

“Both banks and insurance companies are pulling out of coastal areas or areas where there are a lot of fires,” he said at Tuesday’s congressional hearing

What that is going to mean is that if you fast-forward 10 or 15 years, there are going to be regions of the country where you can’t get a mortgage,” he told the banking committee.

The dystopian vision of large swaths of the country where mortgages are simply not available was one conjured up when Democratic Sen. Tina Smith of Minnesota asked about insurers that have pulled out of high-risk areas such as California and Florida, and what that will mean for people trying to get mortgages

In the question and answer portion of the hearing, Smith said her constituents are struggling with a 40% increase in insurance rates in the past seven years, which she attributes to climate change and extreme weather events.

According to climate risk analysis firm First Street, between now and 2055, insurance premiums are projected to skyrocket in many areas, including in Miami, jumping 322% from current levels, followed by Jacksonville, FL (226%), Tampa, FL (213%), New Orleans (196%), and Sacramento, CA (137%).

She went on to call attention to a recent analysis by First Street, which warned that $1.4 trillion will be shaved off the value of U.S. real estate within the next years due to this domino effect“What is going to happen when insurance becomes unaffordable or—in some parts of the country— literally unavailable?” she asked the chairman. “What impact will that have on the mortgage markets?”

Powell admitted that banks would likely make mortgages unavailable in parts of the country, and even pull up stakes entirely, leaving behind mortgage and bank deserts.

“The risk is that [mortgages and banks] just won’t be there. People won’t be able to get them. That is really the issue,” he said.

There won’t be ATMs, the banks won’t have branches,” he went on. “That’s a possibility coming up down the road. The banks won’t stay there and keep making loans in the face of disaster. The insurance companies won’t continue writing policies. They can cancel those policies every year.”

Who pays the price?

As for the onus of the costs of a disaster befalling a property, “that will fall on homeowners and residents, but also state and local governments,” Powell told the committee.

“You see that happening now,” he said. “States are stepping in where private insurance is going away. They want those areas to remain prosperous. It certainly will have significant economic consequences.”

The fact that this comment by JP didn't get more press is really fucking alarming.

He's basically telling you what's going to happen to the housing market and by extension -- the economy, in the future.

-

4 hours ago, Terpeast said:

I know it doesn't feel like it now, but the fact that all the southern areas cashing in at least puts to bed the theory that snowstorm tracks are moving further north and cutting us out. We're still good. If anything, we lost maybe 15-20% of our usual snow climo in the long term. Like Bob Chill, I have a feeling that the next 5-10 winters will be more closer to climo compared to the last 8 years and include at least one big dog, maybe two.

I think at least some of this is being driven by rapid NPac and NAtl warming, driving +height tendencies there and a transient -height tendency over the continent. It was more confined to the Feb-May timeframe over the northern CONUS in the '10s, primarily in response to the north Pacific, but we may see that expand given how quickly both oceans have warmed.

-

2

2

-

2

2

-

-

Ended with:

1.5"-2.5" (north to south) at KNHK.

2.7" at house, 4.5" at Ridge and 6" at Pt. Lookout entrance.

High ratio fluff with a very impressive accumulation gradient.

-

5

5

-

-

Took a little drive down to Ridge and Pt. Lookout after the road crews went through. 4.5" in Ridge and 6.0" at Pt. Lookout entrance. Very fluffy, high ratio stuff. Very sharp gradient!

-

1

1

-

-

Insanely sharp gradient here. 1.5" on north side of KNHK, 2.0 on the station itself and nearly 3" on the south side of the base and at my house. Bet Pt. Lookout to SBY ends up somewhere over 5"

-

Can only imagine what this sucker could've produced with a full phase.

Ah well -- we've got the next 3-4 weeks and hopefully a weak +ENSO/-AO year to play with next year.

-

2

2

-

-

-

That mesoband should be around for a few more hours. Slow mover as that H7 frontogen. zone gradually pivots overhead. Should cash in pretty hard for the areas that get it. It was producing a pretty solid 3/4"/hr for a while here. Looks like around 1"/hr under the core of it right now.

-

3

3

-

-

Solid mesoband established from NHK over to far southern DE. Coming down at about 0.75"/hr here.

-

Half mile in moderate snow under this frontogen. band. Hopefully sticks around for a couple of hours.

-

1

1

-

-

1 hour ago, Lowershoresadness said:

can we steal warning criteria snow from this thing?

Yes, it's not over -- at least for us southerners. Most guidance was north this run, esp. the CAMs. Although I think some of the NAM positioning is due to diabatic processes in the model from convection. They exist, but it's very difficult to model and prone to shifts. Still, it would be great to get some non-linear cyclogenesis and "save" this one from mediocrity.

-

3

3

-

-

Eesh. At this rate, we might be lucky to get 20 inches of cirrus. We'd have been better off without the TPV, tbh. Would've at least gotten a decent southern slider, but it's getting swept and suppressed so far south that we're almost out of the track range.

-

1

1

-

-

Just now, Lowershoresadness said:

next 24 hours crucial?

Yep -- for a big storm anyways. Can still get a light-moderate event just from relatively favorable track of the southern wave effectively being a slider. But in order to keep a big storm, we need the northern wave to play ball at least a little bit.

Global Average Temperature 2025

in Climate Change

Posted

Finally getting some cooling in the past couple of months after that record run for 2 years. CERES 12-month rolling average appears to have bottomed in Nov (March numbers are coming back up and it should recover more substantially when May numbers are out). Temp tends to lag this by quite a bit (up to a year) and cool ENSO could also help throw a lid on things through Q1/Q2 next year, but after that, we're free to start heading back up again barring (yet another) cool-neutral or Nina year.

These next couple of years may see us slide under the 1.5 threshold (on all datasets) for the last time. I get the feeling we won't be seeing it again after the next spike, though.