WolfStock1

Members-

Posts

199 -

Joined

-

Last visited

About WolfStock1

Profile Information

-

Four Letter Airport Code For Weather Obs (Such as KDCA)

LEE

-

Location:

Leesburg, VA

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

IMO trying to use/apply a single decade's worth of data is a fool's errand. There's too much background noise there in the ENSO and solar cycles. IMO anything meaningful with regards to changes in the rate of increase would need to be over at least a 20-year period, or even 30. That said "meaningful" here I equate with "strong evidence". 10-year data isn't totally meaningless - it's worth at least eyebrow-furrowing when it indicates something unusual. I just wouldn't use it to make a statement to the effect of "this shows that the rate of warming is increasing". -

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

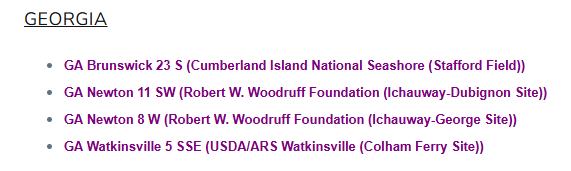

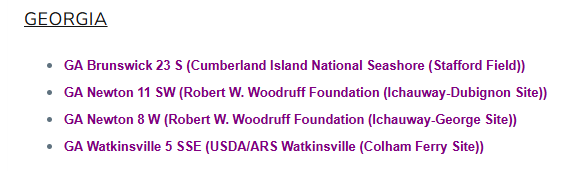

I believe UHI effect, while a thing, is overblown as well. My point though is - deniers like to point to UHI as tainting the data and general claims of trends, so in order to remove all doubt it would be good to have a data set (more than a single station, but rather hundreds of stations) that are truly remote. It appears the USCRN is a mix of some remote and some not-so-remote sites. Doing a filter of the USCRN data and weeding out the not-so-remote sites and presenting an average would seem like the thing to do. The Lake Erie thing actually brings something else to mind. Has anyone done studies on how much water warming (mainly rivers and lakes) is due to general industrialization vs greenhouse effect? It seems like it could be quite significant actually. I mention this because I was looking into water usage recently (context was discussion on data centers) and found that actually one of the biggest water consumers in the US is power plants - used for cooling. There's more water used for cooling power plants than there is for irrigation, believe it or not. Much of this is evaporative but much ends up back in rivers and lakes, raising their temperature. Much is used for other industrial things as well, which certainly raises the temperature some. -

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

Yes unlike many of the others Georgia appears to have done a good job picking truly remote sites. Ideally you'd like to see all the sites be like that, since it's usually an average of all sites that's shown (e.g. in the X post). I haven't looked for it, but was just noticing that a lot of the references in this thread to records / high trends are in areas that may be subject to UHI effect. Would be nice to see some for remote sites instead, since IMO that's much more meaningful. -

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

-

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

Hmmm - well - looking at their locations https://www.ncei.noaa.gov/access/crn/ - that's not really what I'm talking about. It looks like just about all of those sites are actually suburban sites, or at least "close to city" rural sites. For example the one in central NC is in Duke Forest - but that's practically surrounded by Durham, which is a fast-growing urban area. The one in southern LA is at Cade Farm which is rural-ish, but is only 3 miles from the edge of Lafayette. The one in western VA is only 1 mile from I-64 and Charlottesville, Etc. What I'm talking about would be truly rural sites - ones where there isn't a significant city within about 50-100 miles or so. I see very few if any sites of those that fit that bill. -

Occasional Thoughts on Climate Change

WolfStock1 replied to donsutherland1's topic in Climate Change

Not an expert in UHI effects, but Lander isn't exactly the middle of nowhere - it is a town of 7k+ people. What's needed is data like this from actual remote sites, that aren't at cities / towns at all - e.g. sensors at national parks / forests, etc. Remove all question w/regards to UHI. -

-

Feb 22nd/23rd "There's no way..." Obs Thread

WolfStock1 replied to Maestrobjwa's topic in Mid Atlantic

SW of Leesburg VA we got right at 5", so it appears more than most in the area. Was a really sticky and beautiful snow Sunday night. (we got a bit more after the pic was taken) -

Bunk. The world has solved lots of problems, without having solved all of them. The notion that if you can't solve one problem then you can't solve any problem is ludicrous.

-

Your level of understanding of worldwide systems, and your worldview, is made pretty clear from that last sentence. The rest just naturally follows, and isn't even worth addressing. We'll just leave it at that.

-

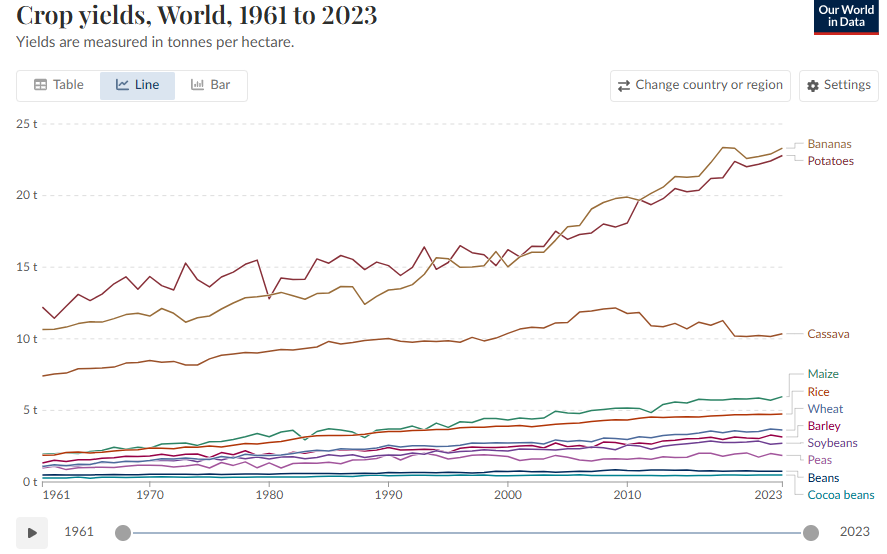

Boy you hit about all the MMGW scapegoat talking points there, didn't you? You forgot about rape though. (Yes, it's a thing) I'll just hit one of the scaries for now - crop failures - the rest can be inferred. The sky-is-falling narrative tends to fall apart when you look at the actual data, and not individual anecdotes. (ironically - much like looking at a weather event and claiming that it's an indicator of climate trends)

-

Well there's also the fact that it's lot harder to survive in extreme cold than it is in extreme heat, which is why so many more people die each year from cold weather. Human comfort / survivability is not one of the negative effects of MMGW. Sea level rise and increase in storms, yes. But not the temperature itself. IMO areas becoming "difficult to survive in" is a non-issue for MMGW. Any slight increase in storm activity is just noise in the overall background of improved infrastructure and weather prediction. A *lot* fewer people die these days from hurricanes and floods than they did in years past. (Sea level rise of course is a non-issue w/regards to survivability; the creep is way slower than natural human birth/death cycles. I always have to laugh when I hear of literal human "danger" proposed as being due to sea level rise.)

-

Are you sure? Why is it that the Wikipedia page on the subject: https://en.wikipedia.org/wiki/Outgoing_longwave_radiation doesn't discuss ENSO? The chart that's there doesn't seem to follow ENSO cycles: Keep in mind we're not talking about radiation *into* the atmosphere here (what I think is most affected by ENSO), we're talking about radiation from all earth elements (including the atmosphere) out into space (outgoing longwave radiation). Though I haven't attempted any kind of mathematical correlation - I thought ENSO cycles were generally much longer duration than what's in that chart.

-

So here's a question. Given that "the planet" is generally a self-contained system with very little (essentially no) variance in externalities with regards to energy inputs (mainly solar irradiance - generally near-constant) and output (terrestrial radiation - generally near-constant) - shouldn't the warming of the planet just be essentially a straight (or curved) line with an always-upwards slope, such that a new record should be set *every* year? Or is it the case that it's really just these records are just really just referring to "the places we are measuring" and not "the planet" as a whole? Yes - question is somewhat rhetorical, but is intended to trigger some thought. If one presumes that the planet as a whole is warming continually, then what are the "holes" in the data? Are there significant areas of the ocean for instance that we're just not measuring, and the reason we don't see a new record every year is because of the non-existent data that would offset the data we do have? Or perhaps is it the case that we are in fact measuring the whole "surface" (including the oceans), but the surface temperature as a whole actually does go up and down based on something - e.g. subterranean effects e.g. "bubbles" in mantle convection, or perhaps solar cycles?

-